Apple Inc. (NASDAQ:AAPL) was downgraded by investment analysts at Vetr from a "strong-buy" rating to a "buy" rating in a report issued on Wednesday, MarketBeat.com reports. They presently have a $119.11 price target on the iPhone maker's stock. Vetr's price objective indicates a potential upside of 11.20% from the company's previous close.

Several other analysts have also recently commented on AAPL. Piper Jaffray Cos. restated an "overweight" rating and set a $153.00 price objective on shares of Apple in a research note on Tuesday, July 26th. Credit Suisse restated an "outperform" rating and set a $150.00 price objective on shares of Apple in a research note on Thursday, September 15th.

Goldman Sachs. restated a "buy" rating and set a $124.00 price objective on shares of Apple in a research note on Wednesday, October 12th. Citigroup). lifted their price objective on shares of Apple from $120.00 to $130.00 and gave the company a "buy" rating in a research note on Friday, September 30th. Finally, Needham & Company LLC reiterated a "buy" rating and issued a $150.00 target price on shares of Apple in a research note on Wednesday, July 20th.

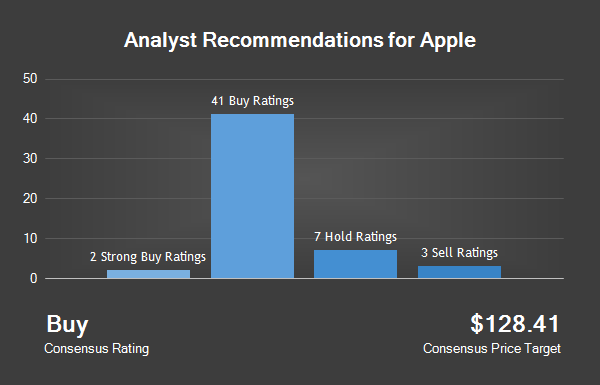

Three equities research analysts have rated the stock with a sell rating, eight have issued a hold rating, forty-two have issued a buy rating and two have given a strong buy rating to the company's stock. The stock currently has a consensus rating of "Buy" and a consensus target price of $128.29.

Shares of Apple opened at 107.11 on Wednesday, MarketBeat.com reports. Apple has a 52 week low of $89.47 and a 52 week high of $119.92. The stock has a 50 day moving average of $113.48 and a 200-day moving average of $104.52. The stock has a market capitalization of $571.14 billion, a PE ratio of 12.89 and a beta of 1.34.

Apple (NASDAQ:AAPL) last issued its quarterly earnings data on Tuesday, October 25th. The iPhone maker reported $1.67 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.66 by $0.01. Apple had a net margin of 21.19% and a return on equity of 35.59%.

The firm had revenue of $46.85 billion for the quarter, compared to the consensus estimate of $46.88 billion. During the same quarter in the previous year, the firm earned $1.96 EPS. The company's quarterly revenue was down 9.0% compared to the same quarter last year. On average, equities research analysts expect that Apple will post $9.04 EPS for the current year.

The business also recently disclosed a quarterly dividend, which was paid on Thursday, November 10th. Investors of record on Monday, November 7th were paid a dividend of $0.57 per share. The ex-dividend date was Thursday, November 3rd. This represents a $2.28 dividend on an annualized basis and a dividend yield of 2.13%. Apple's dividend payout ratio (DPR) is presently 27.57%.

In other Apple news, CFO Luca Maestri sold 16,950 shares of Apple stock in a transaction dated Monday, November 7th. The stock was sold at an average price of $110.03, for a total transaction of $1,865,008.50. Following the transaction, the chief financial officer now directly owns 12,055 shares in the company, valued at $1,326,411.65. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink.

Also, insider Daniel J. Riccio sold 33,323 shares of Apple stock in a transaction dated Thursday, November 3rd. The stock was sold at an average price of $110.35, for a total value of $3,677,193.05. Following the transaction, the insider now owns 32,484 shares in the company, valued at $3,584,609.40. The disclosure for this sale can be found here. Corporate insiders own 0.08% of the company's stock.

A number of hedge funds and other institutional investors have recently bought and sold shares of the company. Vanguard Group Inc. raised its position in Apple by 0.4% in the second quarter. Vanguard Group Inc. now owns 331,395,817 shares of the iPhone maker's stock valued at $31,681,440,000 after buying an additional 1,408,642 shares in the last quarter. BlackRock Fund Advisors raised its position in Apple by 2.1% in the third quarter. BlackRock Fund Advisors now owns 71,122,254 shares of the iPhone maker's stock valued at $8,040,371,000 after buying an additional 1,488,007 shares in the last quarter.

Morgan Stanley raised its position in Apple by 2.5% in the third quarter. Morgan Stanley (NYSE:MS) now owns 48,393,075 shares of the iPhone maker's stock valued at $5,470,837,000 after buying an additional 1,176,566 shares in the last quarter. BlackRock Group LTD raised its stake in shares of Apple by 1.6% in the second quarter. BlackRock Group LTD now owns 48,083,386 shares of the iPhone maker's stock worth $4,596,772,000 after buying an additional 759,339 shares during the period.

Finally, Capital World Investors raised its stake in shares of Apple by 29.5% in the third quarter. Capital World Investors now owns 38,337,447 shares of the iPhone maker's stock worth $4,334,048,000 after buying an additional 8,740,447 shares during the period. Hedge funds and other institutional investors own 56.83% of the company's stock.

Apple Company Profile

Apple Inc designs, manufactures and markets mobile communication and media devices, personal computers, and portable digital music players, and a variety of related software, services, peripherals, networking solutions, and third-party digital content and applications. The Company's products and services include iPhone, iPad, Mac, iPod, Apple TV, a portfolio of consumer and professional software applications, the iOS and OS X operating systems, iCloud, and a variety of accessory, service and support offerings.